-->

2000 379 Peterbilt

What You Need to Know to Become an Owner Operator

6) How to Do Bookkeeping and Other Necessary Paperwork

Permits and Taxes

View my Other Posts:

A Holiday Wish

Blogs, Forums and Othrt Resources

Texting Ban

The Way it Was - A Short History of Trucking

Pro and Cons of Being an Owner Operator

FAQ for the Owner OperatorPicturesAnti-Idling RegulationsDefinitions and Industry TermsBlackrock Auxiliary Power Unit (APU)Interactive Cost per Mile (CPM) Calculator SpreadsheetPrivacy Policy 1) Owner Operator 411 – Welcome2) Income and Expenses3) Financing and Credit4) Operating Authority or Leasing?5) Equipment7) What You Need to Know About Loadboards8) Companies That Lease Beginning Owner Operators9) What You Actually Need to Get Started - Licenses, Permits, Insurance, and Taxes10) Truck Driving Schools

Keep in mind that we have been doing this since 1972, so we will probably miss some stuff. If you dont see what you are looking for, just ask. It is difficult to describe something that to you is routine, but is all Greek to someone else.

Think about when you were learning to use the computer for the first time. You might have asked someone, “How do I find information about ACB company?” The old hand may have said, “After you open your browser, just type their address into the search bar.”

You were probably thinking, “What is a browser and how do I open it? How in the heck do I know what their (mailing) address is? What is a search bar and where do I find it?” To the person explaining it, they were very clear and made perfect sense. To you, their explanation was as clear as mud.

I will try to keep that in mind, but as I said, if I miss something, or dont explain something well enough, let me know and I well see if I can confuse you some more, uh, er, sorry, I mean clear it up.

My advice is to find a good accountant who knows the trucking industry. The rest of this article is to just give you an overview of what and how expenses are counted. Keep in mind that for every rule the IRS has, there are several exceptions.

Where to begin? When I first started as an owner operator, in 1972, there was no such thing as a computer. Everything was done by hand! Can you imagine? At least we had adding machines, but I cant tell you the number of times we would spend a couple of hours going over a column of figures trying to find a mistake.

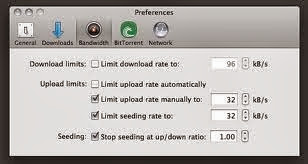

Today all you need is a computerized spreadsheet, or better yet a bookkeeping program. I first started out with something called Lotus. I am now using an old (2000) version of Quicken. It does the job for me, and I dont have any need to change. What program you need to use depends on what you need to track. If all you need is to keep track of is your income, expenses and mileage, any bookkeeping program will do. If you need to track information so you can do your own permits and fuel taxes, or if you plan on hiring an employee, you may want to consider a bookkeeping program geared to the trucking industry. There is a lot of trucking software around, but having never used any, I cant recommend one. If any readers have used any trucking bookkeeping software, especially owner operator software, please leave a comment and tell us what you use, what you use it for, if you like/dislike it and why.

Since the company I am leased to does all of the fuel and mileage taxes, and permits, we dont have a lot of bookwork to do, as we used to. We dont use an accountant. We never did. My wife kept track of the income and expenses and we would take the totals to a tax preparer to have our income taxes done. After finding mistakes for 3 or 4 years, and having to take them back and have them redone, she got tired of that and decided she could do the job as well as they could. She started ordering tax books from the IRS (now days you can get them online), and she started doing our taxes herself.

What kind of paperwork you will need to do, will depend on several factors. There is one rule that cant be broken, however, no matter what else you do: KEEP ALL OF YOUR RECEIPTS! For everything (except maybe meals – see later).

Before I go any further, I want to remind you that we are in the trucking business – not the tax business. Anything I say, you should have checked out by someone - an accountant or tax professional. See "Income and Expenses"

The information I am giving is just our experience and should be used only as a starting point, so you will know what questions to ask of your accountant or tax professional, and to help you understand what they are talking about.

How much of the following you, personally, need to do depends on how much someone else does for you, such as the company you are leased to, or an accountant you hire.

If you are unsure if the person you are going to knows trucking specifically, find someone else. If they give you information that doesnt sound right, call the IRS (or OOIDA) and ask about it. A good source for tax information is trucking magazines and organizations. Owner Operator Independent Drivers Association (OOIDA) is excellent – yes I am a member, no I dont get anything for plugging them. Most trucking magazines will run articles during tax season about tax questions specific to trucking, and some even have monthly tax columns.

If you are an independent owner operator – that is if you have your own authority, you will have to keep (or hire someone to do it for you) records for: every expense, all income, all capital (equipment) expense, miles run in each state, total miles, fuel purchased in each state, total fuel, and drug and alcohol testing (yes, even if you are the only person in your company).

The DOT tells you how drug and alcohol testing has to be done. They have very specific rules about pre-employment, random, and post-accident testing. The most difficult thing for the person who has their own authority and no employees, is the random. In spite of what you might think, you cant just get up one day and say, "Well, I havent had a drug or alcohol test for a while, guess Ill go have it done today." Oh, Nooo! You have to select a "random person" on a "random basis" to have a drug and alcohol test, and you must keep very detailed records about who, how, when, and why. The easiest way to do all of this is to hire a consortium. A consortium pools a lot of individuals together, pulls the random draws and does all of the required paperwork and record keeping.

As I said before, I am an OOIDA member, and I think they are one of the best things that ever happened for the owner operator. OOIDA is a full-service organization and help with drug and alcohol testing for you, as well as help you get your own authority and permits. They have owner operator insurance, trucking and personal vehicle insurance, medical insurance, retirement, financing, and tons of information about the trucking business. Membership fee is only $45.00 a year, which includes their very informative magazine, Land Line.

If you are leased to a company it depends on how much, if any, of the above they take care of on your behalf. Whatever they dont do, you have to.

As I said, keep all of your receipts for everything. If you hire an accountant, you take your receipts and settlement income (pay) statements to them. Some people I know put these receipts in folders with different categories. Some people will even total those categories, but most owner operators I know throw all their receipts in a box and take the box in to their accountant, complete with spilled french fries. Most accountants require that you take this box to them at least once a month.

The perfect way, although I dont know anyone who does this, would be to have a laptop, and enter each expense at the time you buy something, or as soon as possible afterward. I dont advise you to try to enter your toll receipt while driving (ha, ha).

If you are going to be keeping the books yourself, whether or not you do your own taxes, you should enter everything as soon as you can – usually at least weekly. It is so easy to put it off and the first thing you know, it is tax time, and you havent made but one or two months worth of entries.

What records you keep and how you keep them will depend on what type of entity you are. Are you a sole proprietor, a partnership, a LLC, an S corporation, or a corporation? Most likely you will be a LLC.

If you are a sole proprietor, you will use your social security number as your tax number. For all other entities, your will have to file Form SS-4, Application for Employer Identification Number - EIN (you can also file for a EIN online). Its FREE!

If you are a sole (single) proprietor (owner) it is fairly easy to keep records, as everything is 100% yours, income and expenses.

You are also 100% "at risk", meaning all debts, but more importantly, all judgments against your business. In other words, if someone wins a lawsuit against your business, even if your business files bankruptcy, you are still liable for the debts.

You are required to file a Form 1040 Schedule C (or C-EZ) - profit or loss from a business - sole proprietorship, and a Schedule SE - self-employment.

If you are a partnership, it becomes a little more complicated. How is the partnership split? 50/50? 60/40? Something else? It makes a difference when you file your taxes. If it is 50/50 and you buy a $100,000 truck, each of you owns $50,000 worth of the truck. Each of you will share 50% of the income. If you financed the truck, then each of you is responsible for 50% of the debt. Now apply that to 60/40 or some other percentage. See, it is getting a little more complicated. Now are both of you active partners? An active partner is one who participates in the partnership. For example, you drive and your spouse does the bookwork and record keeping. You are both active partners. However, if you drive and you hire an accountant, and your spouse doesnt do anything else, then your spouse is a passive partner, but if you and your spouse drive team, then you are both active partners. Another example: Your brother paid for the truck and wants a percentage of the profits in return, but you do all of the driving, maintenance, and everything else. He is a passive partner. Now, what if you have more than one partner? Some of them could be active and some could be passive.

Which partners are "at risk", and for how much? Are any of them guaranteed a set payment, no matter how much the partnership nets?

You are required to file a Form 1065 (with a Schedule K) - partnership, and give a Schedule K-1 to each partner.

The partnership does not pay taxes. It passes all profits and losses on to the partners using a Schedule K-1. Each partner is required to file on their Form 1040, a Schedule E - supplemental income and loss, and a Schedule SE - self-employment. Each partner then takes his share of profits or losses on their Form 1040 based on the amounts on the Schedule K-1.

A LLC is a Limited Liability Company. It used to be that if you werent a sole proprietor or a partnership, then you had to be a corporation or S corporation (small corporation).

Now they have the LLCs (Limited Liability Corporation) which is a relatively new business structure allowed by state statute.

LLCs are popular because, similar to a corporation, owners have limited personal liability for the debts and actions of the LLC. The reason the owners have limited personal liability is because the LLC is required to carry liability insurance usually for about one million dollars.

Other features of LLCs are more like a partnership, providing management flexibility and the benefit of pass-through taxation (the LLC doesnt pay taxes, but "passes through" the tax liability to each member).

Owners of an LLC are called members. Since most states do not restrict ownership, members may include individuals, corporations, other LLCs and foreign entities. There is no maximum number of members. Most states also permit “single member” LLCs, those having only one owner. Some kind of "Articles of Organization" with your state will be required before becoming an LLC. A limited liability partnership is called a LLP.

Individual members file a Schedule C, partnership members file a Form 1065, and corporations file a Form 1120 or 1120S.

All of this may make a difference in how you track your expenses and income.

When you become an owner operator, you become a businessman, excuse me, businessperson, and you also for some purposes become an employer (even if you dont hire an employee). Because of that, you must pay self-employment taxes on your earned income, which consists of both the employer and employee share of taxes (you are, in effect, hiring yourself). These must be paid to both the Federal and State tax departments. On the other hand, you get to deduct amounts for an IRA (Individual Retirement Account), a SEP (Simplified Employee Pension) plan, health insurance, and 1/2 of your self employment taxes. There may be limits on some of these deductions, so be sure to check it out.

Speaking of being an employer, you can pay your children to wash your truck, your spouse to keep the books, or mother to be a co-driver. These payments are deductible, but you have to pay employer taxes on the amount you pay them (unless one or all are co-owners), and they have to pay income tax on what they earn from you.

On the subject of spouses, if you and your spouse share management decisions, you are automatically considered a partnership by the IRS, unless you elect not to be. If only only of the spouses makes the decisions, and you dont have any other partners, then you will be a sole proprietor and you can hire your spouse, such as to do the bookkeeping. If you do not "opt out" of being a partnership with your spouse, then you have to file a partnership return (Form 1065), an you each share in the expenses and income on a Schedule K-1. See: IRS site: "Husband and Wife Business" for details.

<

Read More..

.jpg)

.jpg)